economy.america.future.letter.to.roxan.2022.03_.5.html

2022-03-15 email to Roxan on economic topics

We are in the gyre! We will reap the whirlwind (Hosea 8:7)

Regarding the petrodollar dominance this news, links below, ought give pause when governments act recklessly. Proforma Biden and his clan have and are behaving very recklessly. The news has not fully come out on MSM - but the U.S. is becoming essentially isolated by the big and medium world players - excluding the NATO fanatics and distance mirages like Australia and New Zealand and the Fiji islands.

Such groups as the BRICS + former USSR -stan states are grouping to buy their oil in China Renminbi and in measured amounts in Russian rubbles. BRIC=Brazil, Russia, India, China and various former Soviet ,,,stan states.

The United Arab League which includes Egypt are also forming the Renminbi denominated oil purchasers. Then go to Indo-China and you are talking a huge block which is swinging to purchasing oil in Renminbi and cutting loose of U.S.A. belligerence which never seems to end.

If, and I think it is a WHEN - Saudi cuts loose of the USA Petro-Dollar agreement it is over for U.S. economically for a very long time. I haven't the time right now to elaborate. But let me share a few facts as the people like an educated politician who demonstrates they know what they are talking about.

Q. Can the U.S. recover its economy if only the FED will stimulate more?

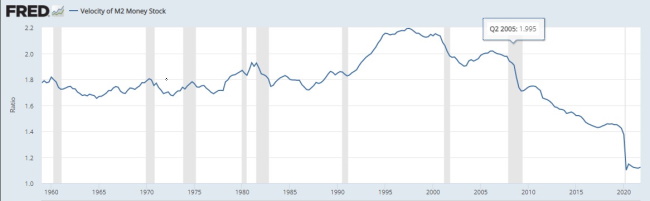

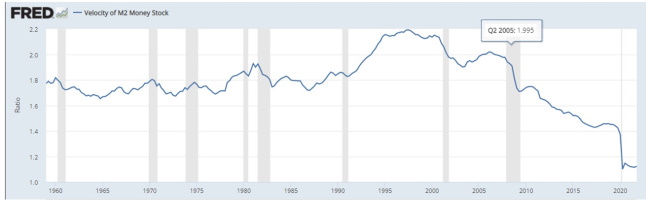

A. Look at FRED M2 velocity of money since 1960, then at 19980-2001 when I contend the real depression started,

Think of velocity of money as measurement indicator of SPENDING. What has happened to spending since, say about 2001? It.s been tanking hasn't it. Remember, velocity of money is essential how many times a single dollar will change hands as one dollar is spent by this hand then that hand and so on – which in effect act as a STIMULANT TO THE ECONOMY. But what is happening in real life as you can see above? And look to the right of the Covid-19 tanking. You see any green shoots or mighty pines starting to grow?

From FRED

https://fred.stlouisfed.org/series/M2V

Frequency: Quarterly

Calculated as the ratio of quarterly nominal GDP to the quarterly average of M2 money stock.

The velocity of money is the frequency [how fast] at which one unit of currency [call it a single dollar] is used to purchase domestically [stuff here in U.S.A. and not - produced in Papua New Guinea such as boots made from monkey skins] goods and services within a given time period. In other words, it is the number of times one dollar is spent to buy goods and services per unit of time.

If the velocity of money is increasing, then more transactions are occurring between individuals in an economy. [That is something even the FED and federal government has figured out]

The frequency of currency exchange can be used to determine the velocity of a given component of the money supply, providing some insight into whether consumers and businesses are saving or spending their money.

There are several components of the money supply,: M1, M2, and MZM (M3 is no longer tracked by the Federal Reserve); these components are arranged on a spectrum of narrowest to broadest.

[Note. M3 WAS the most watched money supply indicator since going back to the early 1980s for me when I started becoming interested in this subject. Because of its exploding nature it became a threat to the FED geniuses. ]

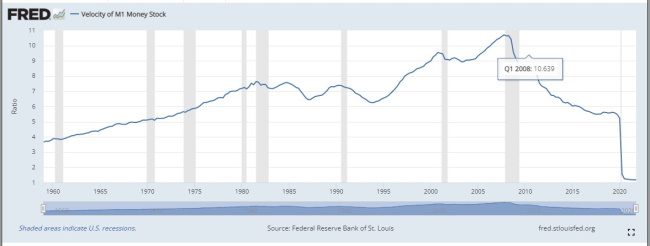

Consider M1, the narrowest component. M1 is the money supply of currency in circulation (notes and coins, traveler's checks [non-bank issuers], demand deposits, and checkable deposits). A decreasing velocity of M1 might indicate fewer short- term consumption transactions are taking place. We can think of shorter- term transactions as consumption we might make on an everyday basis.

Beginning May 2020, M2 consists of M1 plus (1) small-denomination time deposits (time deposits in amounts of less than $100,000) less IRA and Keogh balances at depository institutions; and (2) balances in retail MMFs less IRA and Keogh balances at MMFs. Seasonally adjusted M2 is constructed by summing savings deposits (before May 2020), small-denomination time deposits, and retail MMFs, each seasonally adjusted separately, and adding this result to seasonally adjusted M1. For more information on the H.6 release changes and the regulatory amendment that led to the creation of the other liquid deposits component and its inclusion in the M1 monetary aggregate, see the H.6 announcements and Technical Q&As posted on December 17, 2020.

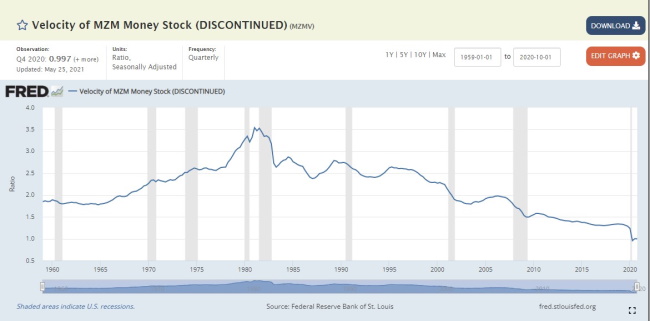

MZM (money with zero maturity) is the broadest component and consists of the supply of financial assets redeemable at par [the face value] on demand: notes and coins in circulation, traveler's checks (non-bank issuers), demand deposits, other checkable deposits, savings deposits, and all money market funds. The velocity of MZM helps determine how often financial assets are switching hands within the economy. [which tells you a great deal and that tells you why the FED shut this indicator down after the flood, or I mean the crash of 2007-2009.}

Suggested Citation:

Federal Reserve Bank of St. Louis, Velocity of M2 Money Stock [M2V], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/M2V, March 14, 2022.

Lets look at M1 velocity of money to see if its shape is dramatically different.

It tells you this country is in a world of hurts.

Now Roxan, look at M3, [MZM] even though the FED scrubbed it from the billboards. Reminds me of how Lenin and Stalin scrubbed Trotsky from the bill boards and newspaper photos after he went out of favor with the "party" and became a pariah (a member, such as congressmen and senators, of the lowest class in southern India)

You still see our economy tanking – even though messiahs such as Fox Larry Kudlow were saying the opposite. The three curves are visual metaphors of this countrie's economy. Note that M3 is the broadest component and has other stuff in it that tend to "flatten the curve." Oh sh*t not that!

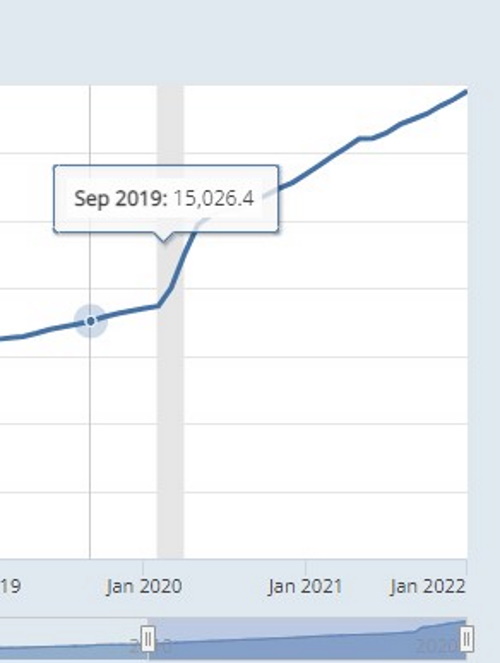

The late and the great U.S.A. has been in a financial mess since the depression of 2001 started. And then, with the atomic explosion of money creation (borrowing by FED) in late 2019 to save once again the 1% super rich and the giant banks from failure, default, and collapse – pre-hyper inflation started. In other words, metaphorically speaking, money creation.

Here's Fred again, our friend because he is honest.

The corn and oats money was fed to the economy, stuffed in its mouth, about Sept 2019, same time when the massive corona virus swept China killing large section of its poultry industry and killing over half the swine, pig, industry. And then, all coincidence of course, the Covid-19 coronavirus somehow escaped the caves of Wuhan or some other place 1,000 miles away and infected Chinese people in a pandemic.

China is effectively the worlds largest prosperous economy. Some claim its success in because it is a blend of mercantile system and part capitalism. But all of that is off topic.

Look what happened to "money creation" not long after the repo market collapsed and the FED came to the rescue once again. Look at that almost vertical climb! And although late 2020 and thru 2021 it is tapering, smoothing and flattening the curve [Oh sh*t] it is still upward bound at an uncontrollable rate. What our democrat doctor governor really did for Kentucky was "FLATTEN THE JOBS IN KENTUCKY" by falling into political alignment with his fellow traveler democrats. He then smashed the dreams and hopes of quite a few million Kentucky citizens. He knew better. He is after all – a medical doctor. He could have spoken out and as a governor AND medical doctor – he would have been heard. But he coward. Hid behind the curtain where schemes to profit from the new virus were being hatched up in their diseased brains.

BACK ON TOPIC. ROXAN, Do you see the contradiction evident by examining the two graphs

.

Can we not say, the more money, debt, the FED pumps into the economy the less the velocity of money. If an apple cost 10 cents you might buy two of them. If it costs 25 cents you are likely only to buy one! When governments create massive amounts of bogus fiat currency – and its value collapses – what happens? Less variety of things are bought because unit price has gone way up. Your fixed dollars limited to you, your income stream, means you cannot buy more. At a certain point – the spending stops and the full crash occurs – the economy collapses. Creating more money, i.e., debt, has a negative effect. You can see in the two graphs – as money creation increases – spending in all sectors decreases.

Creating more debt via fiat money creation drives the economies into negative territory.

There is no escape this time. The penalty caused by the super rich 1% elites will be paid by the poor and middle working class. Is there any way to get change things, and to "get even" on the super rich and banks and Federal Reserve who have caused this calamity?

The only way out will be to vote these wretched villains out of their political office. If you don't do that, don't make the effort, then your world will tumble and collapse onto you and your loved ones.

We are in the gyre! We will reap the whirlwind (Hosea 8:7)